Good news for Americans as data shows that more individuals are saving for their retirement at a much younger age.

Nevertheless, the new report released by the Stanford Center on Longevity reveals that they are not putting enough money for their retirement though.

Taking the Right Steps to Saving

Indeed, most financial advisors recommend that people should save about 10 to 17 percent of their income if they have plans to retire by the age of 65. It doesn’t matter whether they begin saving at 25 or 60 years.

That being said, the study shows that a majority of people are failing to meet the recommended monthly percentage.

Instead, the report shows that working family members aged from 25 to 64 are only saving an average of 8 percent of their income.

One of the research scientists at Stanford, Ms. Tamara Sims, comments on the report, saying that people appear to be saving only half the amount they should be saving on a monthly basis.

Despite more Americans saving for retirement, few of them are actually saving a substantial amount every month

Fostering A Saving Culture at the Workplace

Interestingly, most companies today are automatically placing their employees into 401(k) retirement plans as soon as they are contracted.

Even though it is helping these professionals save, such a setup is also leading to complacency among these professions when it comes to planning their retirement.

They might not be making the best decisions for themselves as individuals. That being said, nearly half of American employees do have access to a retirement plan as they work.

Additionally, the Stanford researchers also analyzed whether an individual’s retirement savings outside of their work setup could be the reason as to why they are so lax about not having enough retirement savings. The end result? The researchers discovered that this was not the case.

According to Sims, she believes the reason for this could be the fact that it is normal in American culture not to associate themselves with old age.

In turn, such a mindset creates a massive implication in that people are not as keen and as willing to invest their time and money in planning for their future as well as their retirement.

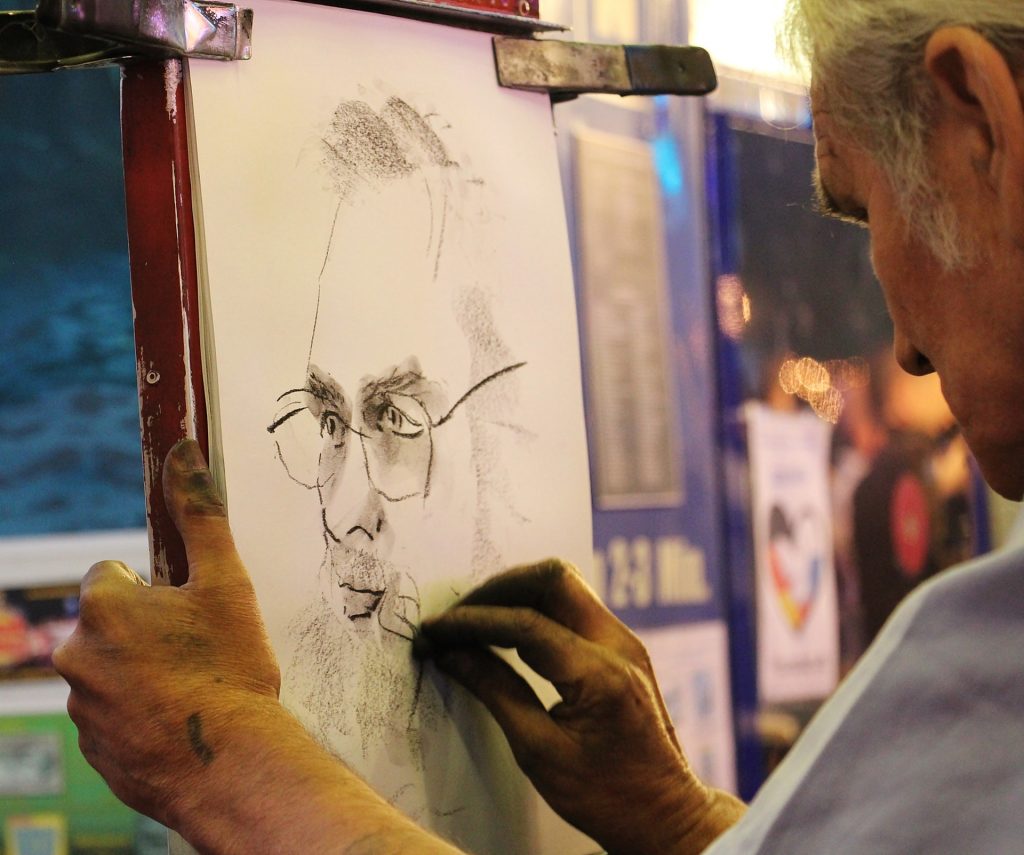

Indeed, Sims notes that they have employed certain strategies to avert such a mindset. For example, some individuals were shown digital images of themselves in the future.

After seeing these images, they were more inclined to direct a part of their income towards saving for retirement.

Saving early can save you a ton of problems down the line such as becoming financially dependent on your family

Why It’s Vital to Save for Retirement

Indeed, saving for retirement is extremely important. For one, you don’t want to be the type of person who depends on the welfare system just to make ends meet during those years of retirement.

Not that there’s anything wrong with welfare. In fact, quite a number of Americans have taken advantage of the welfare system to pursue their dreams of financial independence. The problem arises when this is your only option to lean on during your retirement years!

Not only does it minimize the kind of lifestyle that you live during retirement, but also limits your financial resources. Secondly, when you save wisely, you won’t have to worry about inadvertently becoming a financial burden to your kids simply because you cannot afford your own home or the expenses that come with living alone.

Indeed, being financially dependent might also mean foregoing your independence and freedom simply because you are under that person’s financial backing.

That being said, there are a number of succinct ways in which you can save your money. As a matter of fact, these options fall into two main categories which are primarily tax-deferred and non-tax deferred.

Apart from the financial freedom that comes with saving, it also gives you the opportunity to pursue your hobbies after retirement

Saving the Tax-Deferred Way

While saving is a wise move, the overall effect of saving with the tax-deferred method is normally preferred primarily because:

– It minimizes the amount of taxes on the various savings amount

– It gives you the opportunity to avoid any taxes you might owe, as well as the earnings that come with these investments.

– It results in the effect of earnings-on-earnings, whereby the compound effect is not given in your normal savings account.

Conclusively, coming up with a decent retirement plan early on, and pumping the right amount of money towards your savings account is one sure way of securing your financial future without becoming a burden to your kids, or your family, in the future.