This Early, Society Is Encouraging Millennial Workers To Start Saving For Retirement

When we think of retirement, we usually picture a certain maturity age at which we have been working for more than thirty years of our life. The thought of planning for retirement does not often occur among young workers. There are some, though, who trained themselves to program and plan their life from the moment they started working up to the time that they want to retire.

Retiring may be the last thing on the minds of millennials, but we now see this breed as charting their financial destiny even in the midst of uncertain economic conditions. If you belong to this generation or have a Generation-Y family member, you can learn from this very useful piece of advice on how millennials can prepare for retirement. Is it wise for young workers to start this early? The answer is a resounding YES!

Restructure your loan debts

Restructure your loan debts

Many millennials are still saddled with student loan obligations despite being professionals who are trying to carve their niche in the corporate or business world. For some, loans may be accompanied by other debts that they may have incurred when they started working. Amortization payments can take so much toll on their take-home pay that perhaps many of them would be forced to take at least a second job to live a comfortable life.

When this happens, you may not be able to put aside enough money for your future. Why? Because a chunk of what you earn goes to loan payments and other expenses. However, you can address this situation by exploring a loan restructuring program to lessen the loan burden. In this way, you can adjust your payments and free up a portion of your regular income help you save gradually.

Retiring may be the last thing on the minds of millennials. However, we now see this breed as charting their financial destiny even in the midst of uncertain economic conditions.

“Forced” savings through automation

“Forced” savings through automation

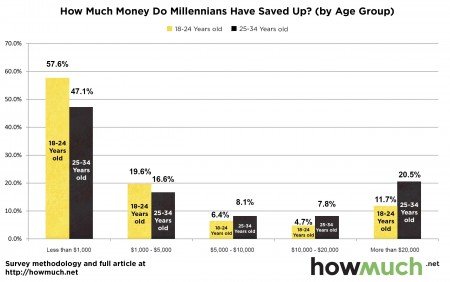

Research has revealed that more than half of American professionals are unable to build a savings account. In planning for retirement, you need to find a definite way of ensuring that you save some money on a regular basis.

Research has revealed that more than half of American professionals are unable to build a savings account. In planning for retirement, you need to find a definite way of ensuring that you save some money on a regular basis.

You can do this by opening a bank account that will allow the automatic transfer of funds from your savings or payroll account. Since everything is automated, you just need to specify the amount you wish to be deposited to your ‘retirement’ account and in what frequency. In the process, you will gain the discipline of periodically setting an amount aside to grow your savings.

Explore the ‘401’ Matching

Explore the ‘401’ Matching

You may be fortunate enough to work for an employer that offers 401 Matching. If so, then all you need to do is to seize this opportunity to create more funds for your retirement. In this employee retirement savings plan, your employer contributes something to match every dollar you contribute for retirement. It is usually a percentage (say 3% or 6% annually) of your pay, which is an extra unrealized income on your part.

Money isn’t everything, but it is when you start thinking about putting money away for your retirement days.” – Andre Leon Talley

Don’t get yourself a new car

Don’t get yourself a new car

Don’t give in to peer pressure or media influence to change your gadget every so often. Not even the car you’re driving. Before you make a purchase, have a mindset of being practical. Do your best to maintain what you have for the next 5 or 10 years (well, maybe not for gadgets, but these can last as well depending on your use). Stick to your plan so that the money that you would have set aside to buy a new car goes somewhere else where it will remain intact.

Nix the cable

Nix the cable

Having an internet connection is a necessity for almost all millennials. Nevertheless, a cable subscription is an expense that most millennials are starting to cut off. The cost of cable amounts to almost a hundred dollars a month. If you set aside this money instead, then that would mean at least a thousand dollars of savings a year. In the event that you can’t do without special films, or you have events that you don’t want to miss, then you can resort to other streaming subscriptions that are much cheaper than cable.

So, for the millennials out there, start thinking of your financial future while you’re still at the peak of your career and productivity. Saving for your future is not an easy task, but you can motivate yourself by picturing your life several years from now. Everyone wants to live comfortably, especially in their retirement age.