All of us dream of having a home someday. It’s one of the basic necessities we should have in life. Not only does having a home provide us our security but it’s also a sign of progress in life. Having a house is a sign that we’re successful in our endeavors. That’s why we strive to build our own dream house someday.

However, acquiring a home has never been easy. We need to go through a lengthy process of getting our house loans approved. Or if not, we need to raise the necessary funds to build them.Then we need to consult architects, engineers, and contractors to design a plan for our home. After that, we need to spend a hefty amount for the property home insurance in case of any emergency.

What can we do to trim somehow the high rates we’ve been paying? Here are top tips to hack your property home insurance.

Check your coverage

Check your coverage

The problem with getting used to paying insurance policies is that you just tend to pay without checking it anymore. You might think that as long as you pay your house insurance, you’re ready to go. While we already know that your insurance provider will cover any catastrophic event that can happen, over-insuring your home is an excellent way to waste your money.

Instead of wasting your money, take time to reread the policy coverage. Assess whether a particular type of coverage applies to your location or not. For example, you might not be living in a flood-prone area so that you can cancel any coverage for floods. Another thing, determine whether your insurance policy covers loss of electronics and jewelry, or if the value has decreased over time. If it has, make the necessary adjustments. You will be able to save the reduced costs from it.

Bolster your home’s security

Bolster your home’s security

Most insurance policies will offer you services about home security. And while it is helpful to keep your home safe, it might also drain your pockets. Before committing to any of these services, first, ask what can be done to secure your home in an affordable way. One way of ensuring your home is safe is to make sure that all doors are locked.

Put up a screen to your windows to make sure it’s clear from any intruders. After that, you may ask your insurance provider for any services to secure your house. Of course, don’t forget to ask for some special discounts or promos they may be offering!

“Safety is a cheap and effective insurance policy.” ~Author unknown

Combine different insurances

Combine different insurances

Instead of paying separate insurances for your properties, ask your insurance provider if there’s any way to combine your insurances. Apart from home security, some insurance providers also offer automobile and life insurance as part of their packages. Instead of having separate coverages with different rates, try to purchase this one. This way, you can save up to 25% on these premiums.

Since insurance providers generally offer more discounts for these packages, you will save more money in the process. Furthermore, you only have to pay for one go! This saves the time you spend going to different institutions just to pay your insurances.

But of course, before you commit to this one, make sure to read every policy you have to know its coverage. Determine which coverage and services to keep and which to ones drop.

Raise Your Deductibles

Raise Your Deductibles

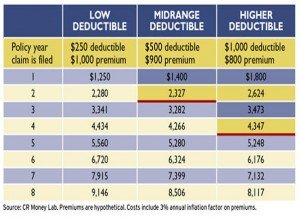

Deductibles refer to the amount you have to pay for any damages in your house. Typically, your insurance providers will provide deductibles for you. However, it’s normally at substantially lower rates because they don’t want to pay for your damages. The problem is that once your house receives more damage than the allotted deductibles, you’ll have to shoulder paying the excess rates from your pocket.

To avoid this, you can raise your deductibles. Ask your insurance providers if they offer more deductible rates. If they can, subscribe for more. However, make sure that you can pay the higher deductible rates without draining your pocket. Having slightly higher deductibles in the long run can be worthwhile.