Like everything else in life, taking a loan is a question of ‘to be or not to.’ Although the concept is a bit different here—it is more like ‘to get or not to get—the point stays the same; you have to dig dip and question yourself. Diving into this pool of possible investment is not an easy task. First and foremost, it cannot be ‘out of the blue’ decision. One cannot just want to take it. It does not work that way. Go for it for the right reasons. Ask yourself the right questions and answer them as honestly as you can. Only you can make that decision; after all, it is you who has to sign those papers—it is on you and only you to pay it later.

“Never expect a loan to a friend to be paid back if you want to keep that friend.” – Bryant H. McGill

Let’s see some of the things you have to deal with.

Step 1

Step 1

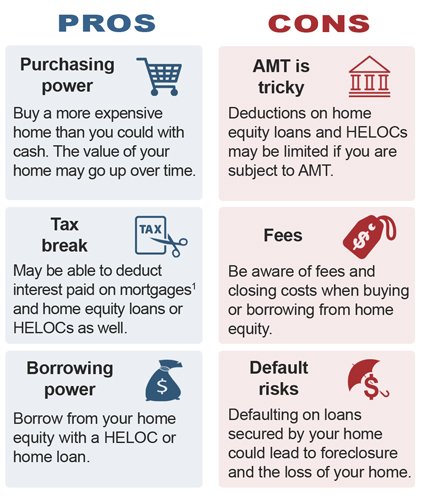

In the way the world works today, everything is possible and accessible over the Internet. Here, there is no stupid question; you just type it and the answer is right there. Before conducting research on the Internet, a small piece of advice: take a sheet of paper and make a list of pros and cons. This will guide you toward or against taking a loan. It is in your best interest before the real interest kicks in once you have signed. That final straw has to be your best judgment.

In the way the world works today, everything is possible and accessible over the Internet. Here, there is no stupid question; you just type it and the answer is right there. Before conducting research on the Internet, a small piece of advice: take a sheet of paper and make a list of pros and cons. This will guide you toward or against taking a loan. It is in your best interest before the real interest kicks in once you have signed. That final straw has to be your best judgment.

Step 2

Step 2

Once you are in, there is no way out of it—well, until the last penny is paid. Only then you are free. It is a long way down the road of paying for this and that. Once you have cleared it with yourself, conduct some research. Search for the best candidate whose conditions work the best way for you. Consider the interest rates (the most important part!); will you be able to pay it on time? Is it going to be paid off in installments?

With all of this taken into the consideration, do not rush with decision making. A hasty decision may cost you even more than you can afford. Do not be fooled by all the shiny promises banks make that can cloud your judgment. You have to realize that when all is done, and you have signed the papers, you are in, and you are in a deep trouble if you cannot handle it.

It is not always easy to put your faith in someone else, especially in the hands of the unpredictable money exchanges. Therefore, you should take your time to think everything through and pick the best offer.

Step 3

Step 3

When all the planning is done, it is time to execute the plan. The moment has come to go in and really do it — ask for money. The process in never a piece of cake and the fear of rejection is always there (even though sometimes this rejection can actually be a good thing for you).

When all the planning is done, it is time to execute the plan. The moment has come to go in and really do it — ask for money. The process in never a piece of cake and the fear of rejection is always there (even though sometimes this rejection can actually be a good thing for you).

Here, you are to be judged and it feels like you are on a trial — with all the silence, awkward looks and fake smiles. They will poke your past, previous experiences, and everything about your ‘dirty’ past may come into the light. Now, they will make it or break it for you. They must ensure that you are the ideal candidate and that you can return their loaned money. Basically, they evaluate how good you and your finances are to make a profit for them?

The wait is over

The wait is over

I know, I know, this is the hardest part—to be evaluated if you are suitable enough for them. The nail-biting moments of agony. It may even feel like it is taking forever, but it shall pass. If you are a responsible person, the odds are in your favor. Your wish will be granted, and the money will be safe in your pocket. Put it to good use.

Remember: you should never take more than you can chew. What if you take and spend more than you can return, who will be in trouble then? Well, obviously, no one but yourself.