The new GOP tax plan introduced by the government could save Americans an average of $1600 on their income tax returns in 2018. The information should have been received with glee by most but about 12% of the taxpayers have complained they expect an increase of $1800 on average.

Does the Average American Benefit from The New GOP Tax Plan?

Does the Average American Benefit from The New GOP Tax Plan?

If the Republican tax overhaul plan is introduced as a law, Americans, regardless of their income, would benefit by about $1600 on their taxes for 2018 according to a report published on Friday, by a watchdog group conducting tax analysis. However, around 12% of the taxpayers, many of whom are in the income bracket of $150,000 and $350,000, may have to deal with a tax increase to the tune of $1800 on their returns for 2018, mainly because itemized deductions have been repealed.

High-income earners would benefit more from the changes made by the GOP, with people earning the highest income benefiting the most. The analysis have been provided by the Tax Policy Center which is a Washington DC-based nonprofit think tank, sponsored by the Brookings institution along with the Urban Institute.

What Are The Benefits of The New GOP Tax Plan?

The Unified Framework For Fixing Our Broken Tax Code

As far as savings are concerned, the top 1% of income tax payees would for instance witness savings of around 8.5% from 2018 to 2027. The figures for the bottom 5% of income earners would, however, only benefit from 0.5% to 1.2% during the same period.

The analysis has been published just days after the Republicans announced their blueprint for the tax overhaul, which looks sweeping, which they have named as The Unified Framework For Fixing Our Broken Tax Code.

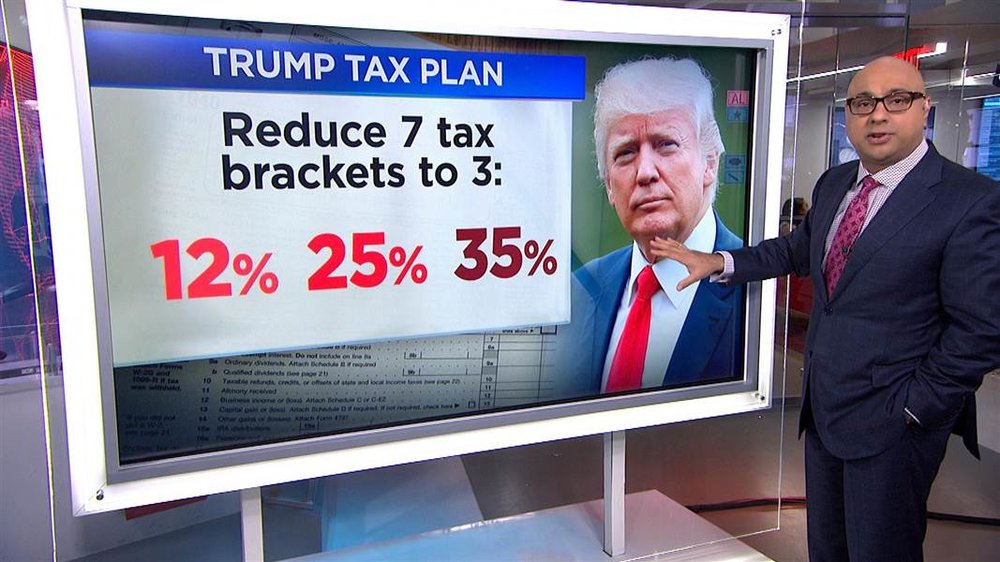

The plan proposed by the GOP brings down the number of taxes to just three, but as nearly doubled the standard deduction and made more people eligible for adult care and childcare tax credits.

The GOP tax plan has also eliminated many other deductions which include those for state and local income taxes while retaining the deductions made for charitable contributions and mortgage interest. The plan has also eliminated the estate tax and AMT which is also known as the alternative minimum tax.

Over the next two decades, about 25% of taxpayers would witness their income taxes rising. Americans earning fewer than $150,000 would be receiving average tax cuts of 0.5% or less, but Americans in the income bracket of $150,000 and $300,000 would be liable on average to pay around $800 in addition to the figure currently assessed.

Over a period of time, the number of taxpayers facing a tax increase will be rising, states the report. The reason for the increase has been attributed because personal exemptions which are usually adjusted for inflation would be replaced by this plan, with additional credits being provided for children and non-children dependents without adjusting the figures for inflation.

The rising tax brackets are closely looking at inflation and also have the potential to make more people liable for tax increases, according to the report.

What Do Analysts Have To Say About The New GOP Tax Plan?

Mixed Views Coming from Analysts Who Are Making Assumptions.

As of this moment, the estimates provided by analysts are just estimates which are not based on concrete evidence. Researchers have just used the figures mentioned in the GOP tax plan, while talking about the fresh tax rates of 12%, 25%, and 35% and have largely made assumptions about the income brackets at which the rates would be applied.

A similar approach had been used by analysts for the brackets outlined by the GOP in 2016. However, the earlier brackets of 10% and 15% have presently been changed to 12%. The 25%, 28% and 30% brackets have now been reintroduced as the 25% bracket. Finally, the 35% and the 39.6% bracket is now changed into the 35% bracket. Therefore, it is quite possible for further changes to be introduced in the years to follow and the figures mentioned should not be considered as the final figures by the governing authorities.

The New GOP Tax Plan Is A Mixed Bag For Everyone.

The plan introduced by the GOP would cost the United States $2.4 trillion over the next decade and $3.2 trillion the decade thereafter, in the absence of any further changes to the tax structure. The changes in revenue could perhaps be because of the proposed reductions in corporate taxes which are costing the country $2.6 trillion during the first decade.

The reductions in individual taxes will bring down revenue by an additional $980 billion out of which $240 billion would be accounted for by the elimination of federal estate taxes.

Much was spoken about how the new GOP tax plan would bring radical changes for Americans in general. However, analysts are stating differently and giving figures which mention that a large chunk of the revenue would be lost just from corporate taxes and Americans would only benefit by a pittance from the new GOP tax plan.

Do you believe the Tax Plan will do the job? Let us have your views on the matter…