Contributing Factors

Disney has announced that it will not launch its streaming service until later in the year. However, investors are starting to understand the business’ economic challenges.

In a recently released filing, it stated that the investment it made in Hulu became the major factor that led to a huge loss of $580 million in equity investments for its last fiscal year which ended on the 30th of September.

Disney stated that the investment it made in Hulu became the major factor that led to a huge loss of $580 million in its equity investments for the last fiscal year

In addition, the titan media company recorded loss totaling $469 million in one of its popular segments (direct to consumer). The loss was primarily from BAMtech. BAMtech is the streaming technology which powers ESPN+ as well as other top notch services.

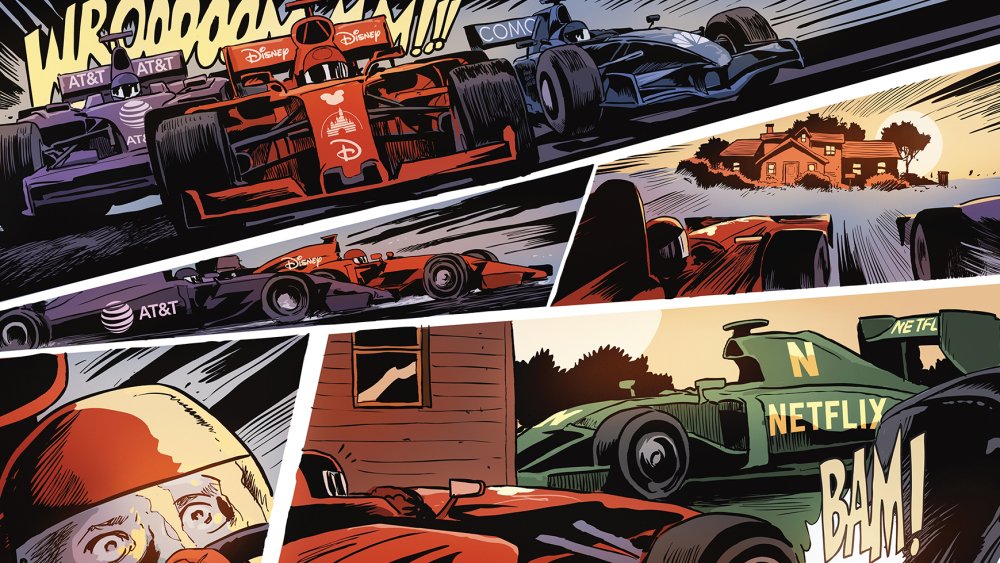

That amounts to over $1 billion loss linked to streaming. It is pertinent to also note that the streaming industry has been the primary focus of the CEO of the company, Bob Iger. Flowing from that, Disney has announced publicly, that it plans to debut a new offering known as Disney+ later in the year, in a bid to increase its ability to compete the likes of Amazon and Netflix.

Future Possibilities

According to a BTIG analyst, Rich Greenfield, the losses the venture would record in streaming would likely increase in its early days because there would be a spike in the costs of technology and content.

At the moment, Disney has still not taken over the control of an additional 30% of Hulu. The additional takeover is a feature of the $71.3 billion deal it made to acquire 21st Century Fox’s majority stake.

If the company goes ahead to acquire the 30% stake owned by Comcast in Hulu, it would add to its operating losses. Greenfield opined that any company going into the streaming industry has to be able to handle unexpected losses from most especially because the company has to play catch-up.

Disney has expressed hope that with time, several paying subscribers would come on board Disney+ so they can access its fresh original content as well as its library of TV shows and movies. The company hasn’t disclosed anything about pricing for now.

Any company going into the streaming industry has to be able to handle losses particularly because the company has to play catch-up.

Last week, the quarterly earnings of Netflix were announced, and the company with 139 million subscribers all across the world also announced that it was increasing prices to 18 percent by 13 percent.

According to reports, Disney first announced that it had become a majority stakeholder in BAMtech in 2017 and its 2018 reports were the first that highlighted the company’s consolidated earnings results.

General Outlook Of Streaming Industry

Even though Netflix has been in the streaming business for a while, that hasn’t changed the fact that streaming is a difficult industry to make money.

Although the company constantly and consistently reveals that an operative income which is on the positive side, it actually burned cash over the course of several years as it tried to raise new debt while expending the generated revenue on producing new content. According to analysts’ estimates, there is a possibility that Netflix would spend more than $10 billion for shows and movies in 2019.

According to analysts’ estimates, there is a possibility that Netflix would spend more than $10 billion for shows and movies in 2019.

Change In Investors’ Focus

In 2018, the media networks of Disney which include ABC, ESPN, Disney Channel among others made $7.3 billion operating income. It is certain that investors’ attention would be turning to the number even as streaming is rapidly becoming the company’s primary focus and as consumers are yet again getting an entertainment option that costs lesser in a deviating move from the typical traditional cable.

The media networks of Disney which include ABC, ESPN, Disney Channel among other networks made $7.3 billion operating income last year

Igler mentioned that it was only fair enough that Wall Street has accepted the fact that the company is making a new move. He added that even though they are not particularly cheering the company on, they are giving the company the much needed opportunity to prove its ability.