Preparing for a secure financial future is highly attainable even in these trying times

“Uncertainty is a quality to be cherished, therefore – if not for it, who would dare to undertake anything?” ― Villiers de L’Isle-Adam

When you think about your future, you tend to worry about how sound your financial situation will be, especially in the midst of volatile political and economic circumstances. You think about your current situation and short-term prospects. Also, you wonder what you should do to start preparing for a worry-free lifestyle. However, no matter what the future holds, you need to think of the NOW. It is advisable that you deal with the things you can control so that as time elapses, you won’t be left in a tight spot. Neither should you be left vulnerable to any potential economic crisis. By adopting these practical and doable tips, you would be well on your way to financial freedom. Besides, you’d have the confidence to face the challenges of time.

Do not panic

Do not panic

Keeping abreast of what’s happening around you is perfectly alright. However, do not let yourself be overwhelmed by any negative news or developments to the extent of feeling distraught. Once you get swayed by the wave of media frenzy about politics, money, and business, you run the risk of being led astray by your emotions. Instead, allow yourself to be guided by your situation, capabilities, opportunities, prospects, and goals. By so doing, you can choose your financial path as objectively as possible. It is your life and nobody else’s. Therefore, you dictate how much money you should have in the bank to take care of your needs. You also determine how much to set aside for your retirement and investments.

Keeping abreast of what’s happening around you is perfectly alright. However, do not let yourself be overwhelmed by any negative news or developments to the extent of feeling distraught. Once you get swayed by the wave of media frenzy about politics, money, and business, you run the risk of being led astray by your emotions. Instead, allow yourself to be guided by your situation, capabilities, opportunities, prospects, and goals. By so doing, you can choose your financial path as objectively as possible. It is your life and nobody else’s. Therefore, you dictate how much money you should have in the bank to take care of your needs. You also determine how much to set aside for your retirement and investments.

“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.” —Robert Kiyosaki

Take care of the basics

Take care of the basics

The future may make you worry because what is uncertain makes you grope in the dark. Nevertheless, the future should not bring you undue stress if you know how to prioritize your needs. Things that you can control now give you the leverage to act despite the economic or political circumstances around you. Just remember to secure the following first:

Your emergency fund.

Your emergency fund.

The fund should take care of your needs for at least three to six months if you still want to continue working after some months. If you’re contemplating on retiring and feeling more uncertain about what lies ahead, then it is best to fatten up your cash reserves further.

Your debts.

Your debts.

Make it a point to pay off your debts as quickly as you can. As a guiding rule, your total debt payments should not go over 36% of your gross. Also, your home mortgage debt amortizations should not exceed 77% of the total debt payments. By observing this guideline, you can have more room to enjoy what’s usually left of your income while still being able to save slowly.

Your insurance.

Your insurance.

Find a way to factor in your expenses insurance cost for your health, life, and properties. Some people view insurance as a waste of money because they spend on something that they don’t actually see and feel. However, once an unexpected and unfortunate event happens, they learn to appreciate the value of insurance. Although self-insurance is not, it is likewise not encouraged. That is unless you have the money to spend should a loss occur.

It is your life and nobody else’s. Therefore you dictate how much money you should have in the bank to take care of your needs, and how much will you set aside for your retirement and investments.

Re-distribute your portfolio for balance

Re-distribute your portfolio for balance

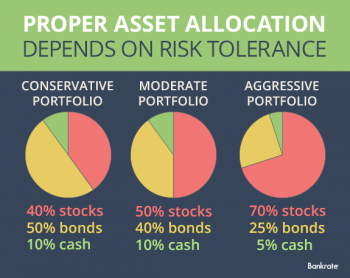

If you have an investment portfolio, it is always wise to balance it depending on the market situation. The reason is that investments that are doing well gain value and make up a bigger portion of your portfolio while other investments become reduced in comparison. It will ultimately change your asset allocation and potentially expose you to increased risk.

If you have an investment portfolio, it is always wise to balance it depending on the market situation. The reason is that investments that are doing well gain value and make up a bigger portion of your portfolio while other investments become reduced in comparison. It will ultimately change your asset allocation and potentially expose you to increased risk.

To address this, you can consider selling a percentage of the assets that have performed well and use the proceeds to purchase more of the assets that did not do well. When you do this, you are effectively raking in profits by selling high and buying low. On the other hand, if you’re beefing up your portfolio, you can invest in assets that have underperformed. You can also opt to look at other investment instruments if you have money to spare. As financial experts would agree, rebalancing is key to smart investing.

“Games are won by players who focus on the playing field –- not by those whose eyes are glued to the scoreboard.” ― Warren Buffett

Formulate a Plan

Formulate a Plan

Seek the expert advice of financial planners if you’re not confident enough about making your financial plan. It has been proven time and again that people who enjoy planning have the edge over anything. They are also always prepared for any eventuality. Making a plan requires you to think of what you want, when you want it, and how you want it done. Money comes and goes, but how fast it comes, stays, and multiplies greatly depend on your money management skills.

If you’re gearing up for retirement or simply setting the stage for a complete financial freedom at a certain age, you need to start acting now or sooner. Living the life that you want is always within your control.