Before we start another series of money tips, let me ask you a question. How much money do you earn every month? I bet you would say around $_ _ _/month. Easy enough, right? Well, let me ask you a couple of follow-up questions. How much money do you spend every month? And on what, exactly?

Now, that indeed shuts your mouth for a few seconds and make you hesitate to answer, right? The truth is, it might be pretty easy to answer, but we just cannot formulate a solid answer because we don’t track our daily expenses. We’re often left wondering how, for a few days, our money already ended. Worse, it keeps on draining faster! Before we knew it, we’re only left with a couple of dollars to sustain us until the next pay day!

“The amount of money you have has got nothing to do with what you earn. People earning a million dollars a year can have no money. People earning $35,000 a year can be quite well off. It’s not what you earn, it’s what you spend.” — Paul Clitheroe

How do we secure yourself from this self-sabotage? How do you avoid being broke? The answer to that is by tracking expenses. You’ll be surprised how it will drastically change your life! Here are the four surprising benefits of tracking your spending.

You’ll have better insight into your spending habits

You’ll have better insight into your spending habits

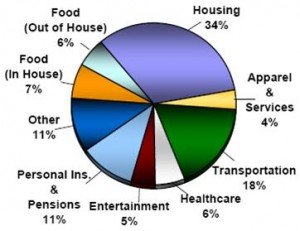

By listing down your spendings, you’ll be able to determine your spending habit. You’ll be able to see where most of your money is going. At last, you can answer the follow-up questions above. Do you really need the things on which you spend your money? Did you just buy those products impulsively?

By listing down your spendings, you’ll be able to determine your spending habit. You’ll be able to see where most of your money is going. At last, you can answer the follow-up questions above. Do you really need the things on which you spend your money? Did you just buy those products impulsively?

Just from tracking your spending, you’ll be able to get an insight what your spending habits are. You’ll be able to see what areas you need to improve on to save more money. If you cannot cut it off completely, at least you can practice to reduce it. If you track your spending, you’ll be able to enhance your money-making and budgeting skills.

You’ll have a better relationship with your spouse or partner

You’ll have a better relationship with your spouse or partner

Let’s face it. One way or another, the main reason why relationships and marriages fail is because of money. You might have seen your parents arguing about money before. Sometimes they argue about why the current budget doesn’t sustain the family for weeks. If you don’t want to suffer the same fate with your family or someone you know, it’s time to start tracking your expenses now.

Listing and tracking your expenses allows for transparency in a relationship. If your partner happens to ask where the money goes, you can just give the list to them. They’ll see that the money is indeed put into proper use. This would essentially save you from the stress of being accused of spending your partner’s salary carelessly!

You’ll be more confident about achieving your financial goals

You’ll be more confident about achieving your financial goals

When you track your spending, you’ll be able to adjust your spending habits and control yourself in managing your finances. This control will make your financial goals more tangible and realistic. Since you already know where you’re money is going, you’ll feel more confident on attaining your financial goals.

You’ll now be able to determine how much you can save, spend, and earn per month. This will give you a clearer picture of what step to take next. Will you be finally ready to get an insurance policy? Are you ready to play your money in the stock market? Only your money list can tell.

You’ll be able to reduce impulse spending

You’ll be able to reduce impulse spending

Now that you’re able to determine where your money is going, you’ll also be able to weigh your wants and needs. You’ll come to realize that you’ve been buying impulsively from time to time. You’ll have to make some changes in your life in order to save more money. Thanks to your tracking, you’re now able to identify the triggers or your impulsive buying.

Therefore, the next time you shop in the mall, you’ll be able to think twice before buying. Do you really need a new set of blouse and skirts? Do you really need to buy that fancy bag when you still have dozens left? You’ll find yourself holding back from buying as you prioritize your needs vs. wants.

“A penny here, and a dollar there, placed at interest, goes on accumulating, and in this way the desired result is attained. It requires some training, perhaps, to accomplish this economy, but when once used to it, you will find there is more satisfaction in rational saving than in irrational spending.” — P. T. Barnum