Despite Tesla’s mishaps and back-to-back controversies, the company faced last year. Many investors were still optimistic the giant electric automaker will have a grand comeback this year. However, it seems the investors are now having a change of heart as they welcome the year 2019 with doubts and fears pertaining to the company’s growth.

The Disturbing News

Tesla’s stocks traded as low as $299.73 and ended the trade at $302.26 last week as the news of low fourth-quarter profit yield and layoffs instigated the investors’ fears about Tesla’s stability. According to Nasdaq’s 100 NDX, Tesla’s shares last Friday were the worst performer for the week as Tesla’s shares plummeted down 13% further.

This, after Tesla, suffered a staggering 12% decline for the past year. All in all, the company’s lost around 4.5% not just in shares performance but also its rank in the S&P 500 index. According to the renowned automotive analyst Garrett Nelson, he suspects Tesla focused too much on increasing its workforce last year in an attempt to keep up with the customer’s demands.

More and more investors doubt whether or not Tesla can still get back its demand and profit this year.

However, the actual demand for car production decreased last year due to issues and controversies plaguing the company. This caused Tesla to layoff some of its employees this year to cut down their costs.

Nelson adds that while cost-cutting is generally deemed as a positive movement for any automaker company, it might not be the case with Tesla. According to him, Tesla investors are now questioning whether the said move is really due to the declining demand of sports cars in general, or due to Tesla’s internal issues.

The Layoffs

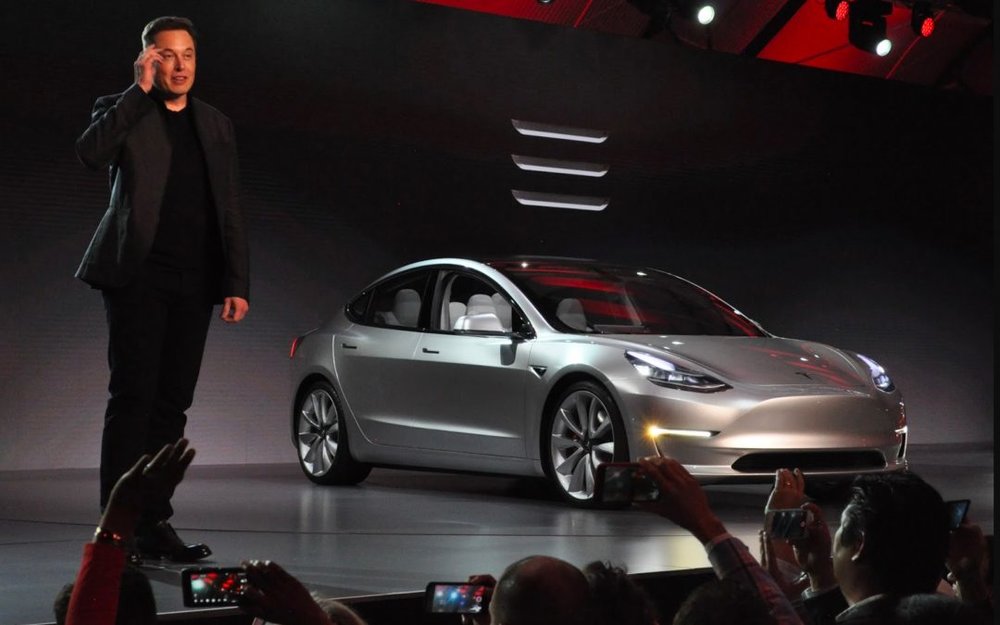

The news of layoffs first emerged in The Wall Street Journal when the website reviewed the memo received by Tesla employees. The speculation was validated when the company posted its fourth-quarter profits results as well as the memo. According to the CEO Elon Musk, the quarterly earnings yield in the last quarter of 2018 was significantly lower than their Q3 performance.

To recuperate, Tesla says they’ll cut down Model 3’s price to make it more affordable for car owners and increase its demand. Furthermore, Musk warns against possible layoffs in their workforce to cut down their costs and redirect their extra money into producing more cars to meet their customers’ demand and increase their sales.

Despite Musk’ swift actions to counter their low-performance lasts quarter, many analysts claim Tesla is in a tough spot this year.

According to Wedbush analyst Dan Ives, Tesla is in a tight spot right now and its actions to reverse their declining performance will define the company’s future in the next few years. He adds that if Tesla ramps up its Model 3 prices as the tax credit starts rolling off across the country, this may also affect the demand for availing sports cars. It’s also expected for some investors to view this move negatively as it raises more questions for Tesla than answers.

Tesla is in a crucial spot to improve its sales to settle the issue once and for all until they are able to publish their earnings report for the first quarter of 2019 this March.

A Positive Year Ahead

Elon Musk is also confident Tesla will be restoring its high sales and profit before this year ends.

Despite Tesla opening the year with a setback, some analysts are confident the company will emerge stronger and more victorious this year. Ives says Tesla will overcome this hurdle and will hail more profitable nunbers for the next coming years.

Meanwhile, Jed Dosheimer says while investors are stepping back to observe Tesla’s performance for the meantime, they view it as a positive outlook to realign the company’s goals as well as theirs to have a prosperous year ahead. He also says some investors latched onto the opportunity to buy more stocks since they’re confident Tesla’s stocks will rebound in no time.