Despite Trump’s reassurances that the new GOP tax bill will not benefit corporations or the wealthy, millionaires around the country are celebrating because they are about to get a whole lot richer. The new Act has cut corporate tax from 35% to 21% and the top bracket for individual tax rate has dropped down to 37%. All tax changes are set for implementation from 2018 onwards.

But while the tax bill is obviously in the favor of Trump’s rich socialite friends, it’s still unclear how it will affect the average taxpayer in America. Here is a breakdown of how the income taxes, deductions and business taxes will change starting next year.

Income Taxes and Deductions

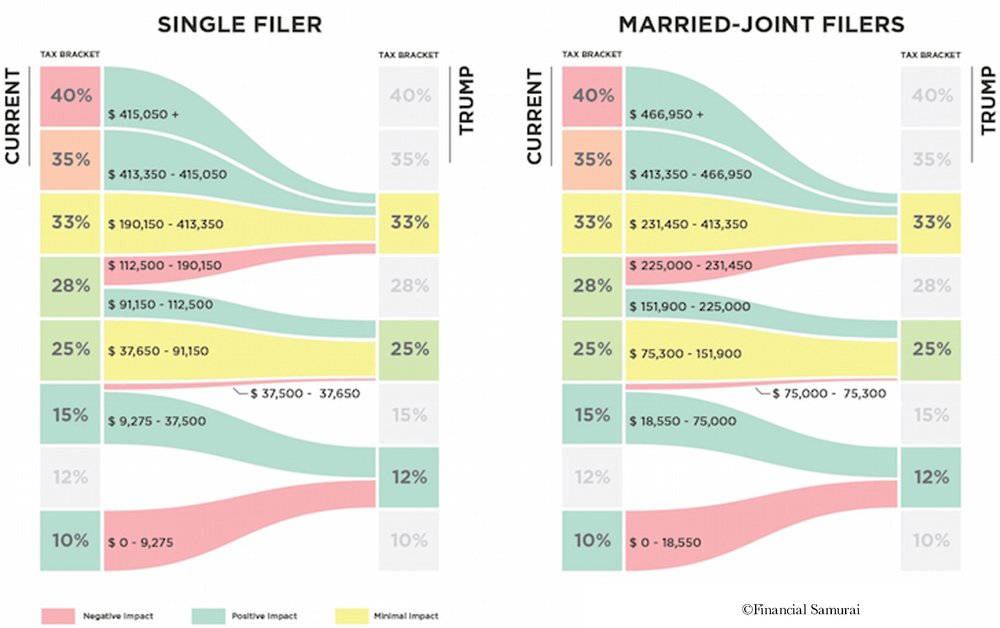

The biggest change seen in the new bill is the lower rates for all seven tax brackets. The new change will be implemented in employees’ paycheck from February 2018 onwards and the bill will not be reverted back to the old rates before 2026.

The standard deductions have also doubled for both single filers and joint filers. Married couples will be able to deduct as much as $24,000 from their taxes, almost twice as much as the previous amount of $12,700. However, the increased deductions will not be very beneficial since personal exemptions have been eliminated by the act. Taxpayers were able to deduct up to $4,150 for each member claimed before the Act which means that bigger families will now pay higher taxes even after using the doubled standard deductions.

Itemized deductions have also been eliminated along with personal exemptions. Taxpayers who pay alimonies will no longer be able to deduct them from their taxes. Other expenses such as interest for home-equity loans and moving expenses will be non-deductible. However, taxpayers will still be able to make deductions for student loan interest and retirement savings. If you take out mortgage after the bill becomes effective, you will only be able to deduct interest from the first $750,000 of the loan. Current mortgage owners will not be affected by the Act.

Taxpayers in states like California with higher tax rates, can expect to pay more next year since the state tax deduction has been reduced to $10,000. However, the Act makes it easier for people to obtain deductions on medical expenses that make up for 7.5% or more of their income. The previous bill allowed cutoff only if the expenses were 10% or higher.

Corporate and Business Taxes

Large corporations have gotten away with paying little to no taxes even before Trump lowered the corporate rate to 21% in the new Act. The wealthy have used tax attorneys whose job is to find loopholes in the tax bill to prevent their clients from paying higher taxes. Even Trump himself has been accused of tax evasion since he hasn’t shown any of his tax returns yet.

Even Trump himself has been accused of tax evasion since he hasn’t shown any of his tax returns yet

Pass-through business including partnerships, LLCs and sole proprietorships, who don’t have to pay high corporate taxes, can avail deductions up to an income of $157,500 for single filers and $315,000 for joint filers. This is good news for small business owners who will likely pay less taxes from next year onwards. Businesses will now also be able to deduct their assets’ depreciation costs annually instead of adding them for several years. This tax rule only applies to equipment purchased after September, 2017.

The Act also lowers the income rate for firms at which carried interest is taxed. The income rate is lowered from 39.6% to 23.8% but the rule does not apply to assets that have been held for less than three years. Frequent traders for hedge funds will likely to be at a disadvantage with this new tax rule, but on the whole, businesses will make over one billion dollars in additional revenue from this change.

The new corporate tax cuts are the lowest they have ever been in the history of America

Taxes on alcohol have also been cut as a result of the act which may lower the prices of liquor. Experts are expressing concern over this new law which is likely to increase alcohol-related deaths by 1550 according to the Brookings Institute.

The new corporate tax cuts are the lowest they have ever been in the history of America, and it is evident that the new plan benefits the rich more than the average Americans. Trump’s corporate and business tax cuts are permanent which means that the wealthy will continue to enjoy tax benefits for the rest of their lives.