Gold is a chemical element and is considered a transition metal. It occurs in a free native form in rocks, veins, and in alluvial deposits. Historically, people consider gold a precious metal that is used to manufacture jewelry, coinage, and other artifacts. As of 2015, a total of around 187,000 tons of gold existed above the ground.

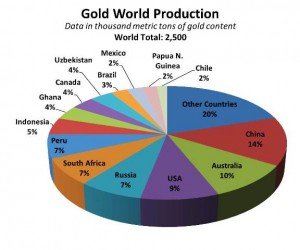

According to statistics, fifty percent of the world’s consumption of new gold is attributed to jewelry, forty percent to investments, and ten percent to industry. China is the world’s largest gold producer at 450 tons.

According to statistics, fifty percent of the world’s consumption of new gold is attributed to jewelry, forty percent to investments, and ten percent to industry. China is the world’s largest gold producer at 450 tons.

The most malleable of all metals, gold continues to be one of the most sought-after commodities on the mineral market. It is no wonder that it’s still a great form of investment in almost all countries.

Gold is still seen as a great form of investment in virtually all countries.

Before we start spending money on this precious metal, it is best to know what we’re getting into, and why we should even consider buying gold.

Why consider investing in gold?

There may be more than one reason why people opt to invest in gold, but the predominant reasons are likely to be the following:

Accessibility. Nowadays, buying gold has become easier and faster. As such, anyone with the resources to do so can efficiently purchase and own gold in any form available.

Accessibility. Nowadays, buying gold has become easier and faster. As such, anyone with the resources to do so can efficiently purchase and own gold in any form available.

Inflation. Gold’s has marvelously maintained its value for the last hundred years. The value of currencies may devaluate over the years. However, gold can weather the effect of inflation. Eventually, it could very well become a currency itself.

Inflation. Gold’s has marvelously maintained its value for the last hundred years. The value of currencies may devaluate over the years. However, gold can weather the effect of inflation. Eventually, it could very well become a currency itself.

Economic Uncertainty. Some people buy gold to protect themselves from possible financial crises. Because of its stable value, gold can be used for bartering should the need arise.

Economic Uncertainty. Some people buy gold to protect themselves from possible financial crises. Because of its stable value, gold can be used for bartering should the need arise.

Wealth. People also purchase gold to preserve their wealth and create wealth. Gold’s performance has proven to be robust and consistent for many years. In fact, it will likely continue this way even in the midst of any financial crisis.

Wealth. People also purchase gold to preserve their wealth and create wealth. Gold’s performance has proven to be robust and consistent for many years. In fact, it will likely continue this way even in the midst of any financial crisis.

In what form can we buy gold?

Investment experts recommend that you allot your investment portfolio to precious metals as a way of diversification. You can purchase gold in varying forms and quantities. You can choose from any of these forms:

Gold Bars

Gold Bars

Usually, these are available anywhere between one and ten-ounce weights. Also, there are bigger bars that are held by governments and central banks.

By buying larger gold bars instead of smaller ones, buyers get pricing that approximates the spot price of gold. Gold bars also have the widest range of sizes, have the lowest spot price, and are highly liquid in the physical markets.

Coins

Coins

Those who buy gold coins have an opportunity to have a bullion type of investment and a collectible at the same time. Coins are limited, and because rarity breeds demand, the prices shoot up rather high compared to the other forms of gold.

Those who buy gold coins have an opportunity to have a bullion type of investment and a collectible at the same time. Coins are limited, and because rarity breeds demand, the prices shoot up rather high compared to the other forms of gold.

Although there are various types of coins in the market, gold investors strongly recommend coins that are readily available, highly liquid, and suitable for investment purposes. Examples include the Canadian Maple Leaf, the Australian Kangaroo, the American Eagle, the Chinese Panda, the Gold Buffalo, the Mexican Libertad, and the South African Krugerrand. These coins typically consist of 22 to 24 karats of gold.

Numismatic coins are even more expensive than other gold coins. This is because they are considered collectors’ items. More often than not, they are sold at 30% to 80% above their gold value.

Before investing in this particular kind of coin, study and understand the economics behind it. You will not just be investing in the value of gold, but also its rarity. Quantifying the value of numismatic coins is hard. As such, most investors are in it for the hobby more than anything else.

Jewelry

Jewelry

In the case of gold jewelry, the price is dependent upon the gold value and its quality, design, craftsmanship, and appeal to the buyer/wearer. Therefore, you need to understand how pure the gold is since most jewelry pieces are gold-plated. For a real investment, go for not less than 18-carat gold pieces. It’s also important to have an excellent appreciation of the jewelry and its market value. Beware of jewelry that is being sold with a high markup price. Try to research to compare the gold spot price with that of the retail price of the item.

Now that you have an idea of how to invest in gold, always remember that you have to understand your primary purpose for buying one in the first place.