Having a business is everyone’s dream. We all dream of having a running business where we’re the one calling the shots. We won’t have to worry about waking up early in the morning or rushing through the peak hours so that we won’t be penalized for being late anymore. When we’re the boss, we take control of our business operation as well as our personal time. That’s why it is our milestone goal to own a business someday.

However, building a business is easier said than done. The number one factor we need to consider is capital to establish the business. If you’re lucky to have enough savings to sustain your business, good for you. But what about those people who lack sufficient capital to raise their businesses? What are their sources of capital?

When we’re the boss, we take control of our business operation as well as our personal time.

One financial source you can depend on is a loan. Did you know that there are various types of loans? Read on:

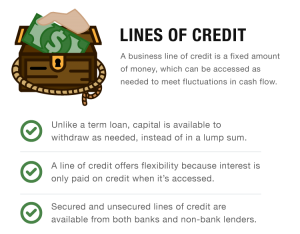

Line-of-Credit

Line-of-Credit

This is the recommended type of loan especially to those who are still starting out their business. This type of loan not only gives you an investment or finance to capital your business, but it also helps in protecting your company from any emergency cases or financial restraint you may encounter in the future.

Line-of-credit also has one of the lowest interest rates out of all other loans available. Banks and other financial institutions can call off the loan in case your company encounters trouble. In this way, you won’t risk closing your company because of bankruptcy. What’s also great about this loan is that you can pay the interest every month and pay the principal amount when it’s convenient for you. This type of loan typically last a year, so it’s easier to clear.

Installment Loans

Installment Loans

This kind of loan can be paid according to your terms of payment: either monthly, quarterly, semi-annually or annually. The payment covers the principal amount plus the interest rate. This is an excellent choice for startup businesses because it gives you flexibility as you’re still testing the waters. You don’t have to pay for a hefty amount of loan in case your business goes downward the spiral. It’s also a low-risk loan. We recommend that you choose monthly or quarterly so that your payment won’t pile up on its due date.

Balloon Loans

Balloon Loans

In this type of loan, the lender has to wait for a specific time to elapse before they start receiving payments from the clients. This loan works similarly as the installment loans. However, the registration contract is often carried under a different name. Fuththrtmore, you can only pay the interest as long as the loan is still alive.

Interim Loans

Interim Loans

If your business is already running steadily and your flow cash is stable, then we recommend this loan. An interim loan is perfect for businesses that can repay the loan, and their guarantee is dependable. The periodic payments are often paid by contractors looking or new facilities. In some cases, those who are into mortgage industry can pay the loan with some collateral at stake.

Secured and Unsecured loans

Secured and Unsecured loans

Whatever type of loans you plan to get in the future, there are two forms, the secured and unsecured loans. If you have a good friend who is a lender and they believe that your business will grow, plus they’re confident enough that you’ll pay your loans diligently, they may give you an unsecured loan. They may become your co-maker to help you get your loan. The risk with an unsecured loan is that there’s no insurance or pledge you if you fail to pay the loan. That’s why, sometimes, it’s difficult to get an unsecured loan because you’ll be dragging your co-maker’s reputation down in such a case. Your lender must be smart enough to let you enter this type of loan. Most of the times, they only commit to low-risk unsecured loans.

Secured loans, on the other hand, required a collateral just in case you fail to pay the loan. There’s no harm done here as everything is insured. However, the only downside is that you’ll be losing some of your properties if you default.