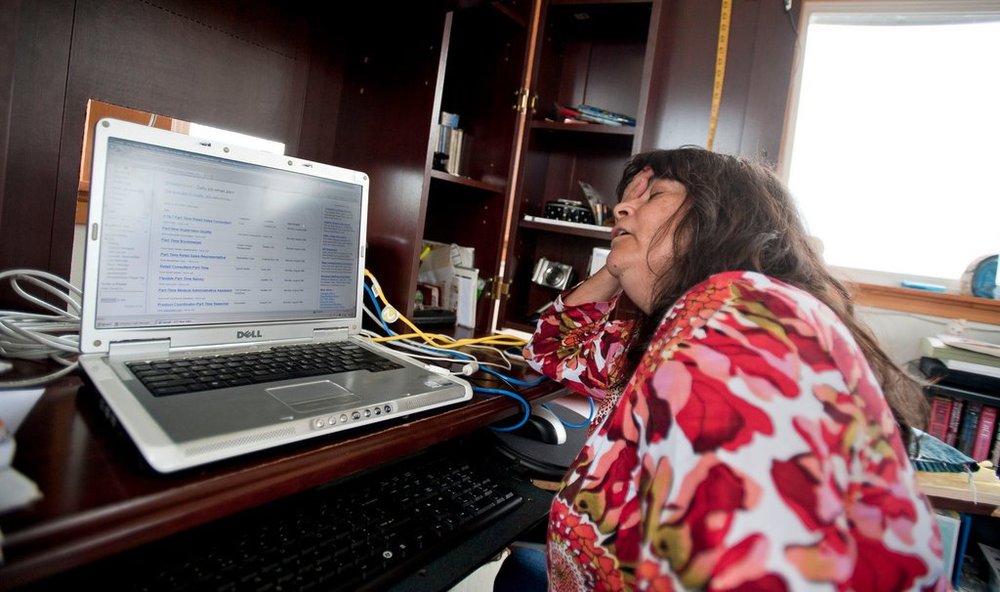

According to studies conducted by Sun Life Financial, approximately 20% of American workers are getting into forced retirement because of shutdowns, layoffs, and cutbacks. This new phenomenon is leaving people with nearly half the expected savings and investments they had anticipated for their golden years. Not every employee is being asked to take forced retirement because of reasons which companies have. The second leading cause of forced retirement is because of injury and illness, while family obligations are also playing a role in men and women both seeking early retirement.

Forced Retirements Are No Longer The Exception

Retirement is not a subject which can be dealt with by everyone who may not be prepared for the same. People who are getting into forced retirement must have a proper understanding of how they can protect their investments and move forward to begin a new life. The beliefs they held earlier no longer exist. Earlier, it was common to see men and women working for a company with a long and fulfilling career which in return provided them with a comfortable retirement. People can no longer believe they can enjoy such benefits in most but a few exceptional cases. The experience people enjoyed earlier doesn’t exist any longer.

The Earlier Paradigm Of The Company Man Or Woman No Longer Exists

Media factions have been commenting that the changes which are being observed are actually great for the economy of the country. The industries that were passing on the most generous benefits could hardly afford the costs, even as they attempted to keep their employees happy. The penalties are being borne by the present generation that is required to face the brunt of corporate bankruptcies. The ramifications of the changes are clear because industries are facing the pinch of the higher expenses. The matter becomes even more exasperated when it is taken into account that the actual owners of the industries are shareholders and not the management of the workforce. Therefore, the concept of forced retirement has been introduced leaving a number of people disappointed with the fact they cannot continue to work or even lead lifestyles which they had been doing. People who are being asked to go into forced retirement will need to make some adjustments in order to lead a comfortable life by understanding they are the only ones who can provide for their retirement. What can people do to combat this problem?

Adjusting The Expense Structure Is Essential When Forced Retirement Is on the Cards

Certain Luxuries Must Be Avoided By People Pushed into Forced Retirement

Forced retirement is an unexpected financial burden but if people continue leading their lives without making adjustments to their expense structure, they will be unable to manage appropriately. People cannot afford to accept financial responsibilities in the form of car payments and certain luxuries. When being forced into early retirement, it is a requirement for people to understand where they actually stand and decide to cut down non-vital expenses, despite believing they could possibly afford them. They may even have to dispose their present new car and decide to purchase a used car which is in pretty good condition. The objective is to ensure that the net worth of the individual does not diminish in value just because they are living by using their own cash. As people will no longer benefit from some of the freebies provided by their employers, they should consider methods to generate some revenue which can help them to maintain their cash flow. The actions they take will prove beneficial without burning a hole in their pocket, even as they continue reducing their expenditure.

Ignoring The 401(k) Is Advised For People Forced into Early Retirement

401(k) Better Ignored By People Forced To Retire Early

After being forced into early retirement and cutting down expenditure, people may well begin to believe they need to dip into their 401(k) and withdraw some money to meet short-term cash requirements. This would be a BAD decision because any withdrawals from the 401(k) are liable to be taxed at regular rates and people will also have to bear a penalty of 10% for the withdrawal. This does not take into account the losses in compounded interest which people would be liable to lose. The figure that people could lose would be staggering. Rather than look at the 401(k), people are advised to utilize alternative methods of getting an extra job or even searching for zero interest credit cards to manage their lives for the time being. By doing so, they will be investing in their future and will have a significant sum of money in their account when they ultimately decide to call it a day.

Should People Consider Taking A Buyout?

When Considering A Buyout Proper Thought Needs to Be Applied

Employers are often trying to satisfy the demands of their shareholders and Board of Directors when trying to cut down costs to save the company or improve performance. In these circumstances, they are often prepared to offer employees early buyouts and encourage them to retire early with a predetermined set of benefits, which can include cash payments, lifetime annuities and more. A buyout can be a great tool for the company and also the employees. However, the onus on deciding whether to accept a buyout or not will depend on the individual asked to volunteer for early retirement. They must ask themselves certain questions before they decide in favor of the buyout or act against it. The questions they need to ask themselves are:

- Am I reporting for work because of reasons other than the paycheck? If the answer just concentrates on the paycheck a buyout is advisable.

- Can I find an alternative job quickly to ensure I can and the buyout added to my existing retirement accounts? If the answer to this question is positive, it can actually be a well-needed boost that will take the individual to his or her financial goals.

- Will I be laid off if I don’t accept the buyout offer? Employers are often laying off employees that refuse buyout offers with just a fraction of the amount they would have paid. This is one of the most important questions people must consider when asked to take an early retirement. The benefits offered in a buyout are usually higher than when an employee is laid off for any reason.

In present-day circumstances, forced retirement is a reality which can befall an individual. Dealing with forced retirement is certainly difficult but not impossible and people who are willing to consider some of the points mentioned in this article will find it helpful to manage their lives comfortably, despite being forced into retirement earlier than expected.