Managing Your Personal Finances is Easy if You Know What Works for You

When it comes to taking care of your money, no formula for success works for all people. To put some form of “order” into your finances, you have to look at three things:

- Your lifestyle and spending habits.

- How MUCH money you earn and can save.

- The amount of time you’re willing to devote to the course.

It is timely to think about it now, more so because “it’s never too late.” Money experts would probably tell you stuff that you already know. However, studies have found that there are some few common ways that people employ to put their finances in order.

“Money is a guarantee that we may have what we want in the future. Though we need nothing at the moment it insures the possibility of satisfying a new desire when it arises.” – Aristotle

Automate what you can

Automate what you can

The most convenient way to ensure that you pay your bills and obligations on time is to automate most of your payments. You can enroll your regular bills online and opt for an automatic debit arrangement based on different schedules. The advantage is that you don’t miss out on due dates and incur “unnecessary” penalties. However, you need to maintain an adequate source of funds from where payments will be drawn. Also, remember that not all bills can be automated.

Moreover, consider the possibility of system glitches (and it does happen sometimes) that may inconvenience you. If they occur, report any suspected erroneous transaction to the bank. This brings us to the other side of automation. You need to review your statements of accounts on a monthly basis to see if everything’s in order.

Take advantage of ‘rewards system’

Take advantage of ‘rewards system’

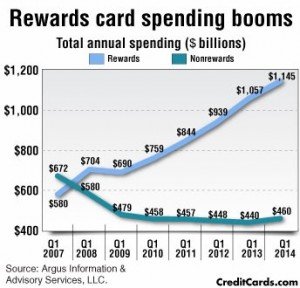

Credit cards offer reward points whenever you charge or purchase an item or service. If you’re the type who never misses out on a payment deadline and always pays the full amount, then enroll your utility and other regular bills for rewards or points system. You will earn points in exchange for some form of rewards, such as rebates or credit values.

Credit cards offer reward points whenever you charge or purchase an item or service. If you’re the type who never misses out on a payment deadline and always pays the full amount, then enroll your utility and other regular bills for rewards or points system. You will earn points in exchange for some form of rewards, such as rebates or credit values.

Word of warning, though: do not be a slave to the points system such that you make “hasty” or “unplanned” purchases to increase your points.

Use apps to micromanage your money

Use apps to micromanage your money

You’re probably the type who would take a “hands-on approach.” If so there are some apps available to help you with several things:

- Monitor your spending

- Set savings targets

- Ensure that you stay on track

This method enables you to stay focused on the way you spend and save. By so doing, you never miss out on anything.

However, it proves tedious if you do not like going into details or regularly monitoring the figures. The advantage of having an app is that you can access and work on your record even from your mobile device. This comes in handy, especially as you can post any transaction (say, grocery) in real-time.

Pay as they come

Pay as they come

If you’re comfortable paying your bills “as they arrive,” you need to have a “more-than-adequate” financial resource. Doing so ensures that there are no surprises should a one-time significant expense arise. It is also wise to regularly check on your long-term spending habits. Expenses can sometimes get out of hand, resulting in overdrafts or touching your savings account.

Pay what you can

Pay what you can

Some people feel comfortable paying only what they can from month to month. This strategy can be rather dangerous, especially if you have not sat down to evaluate the bigger picture. It is, therefore, important to examine your earnings, savings, regular bills, and other expenses to get a better idea of your capacity to pay. In this way, it would be easier for you to establish a course of action on how to eliminate or slowly pay off any existing debt and find the most suitable way to keep you afloat.

You may not agree with these common strategies. However, certain people make use of at least one of them to manage their money. Just keep in mind that your method should allow to:

- Settle your bills on time;

- Minimize or entirely eradicate any debt.

- Have money to spend and save.